Prevent payment fraud directly from Sage X3

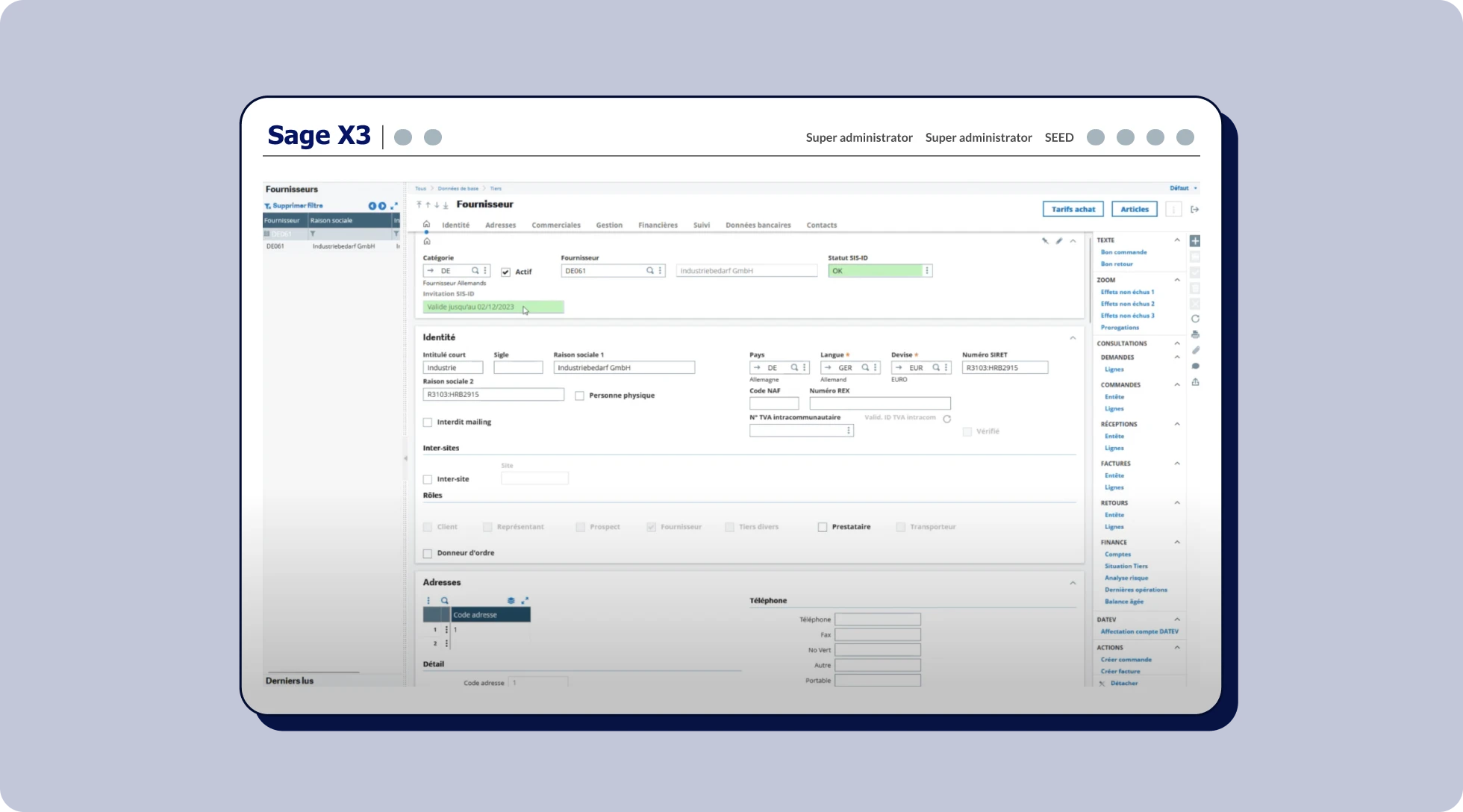

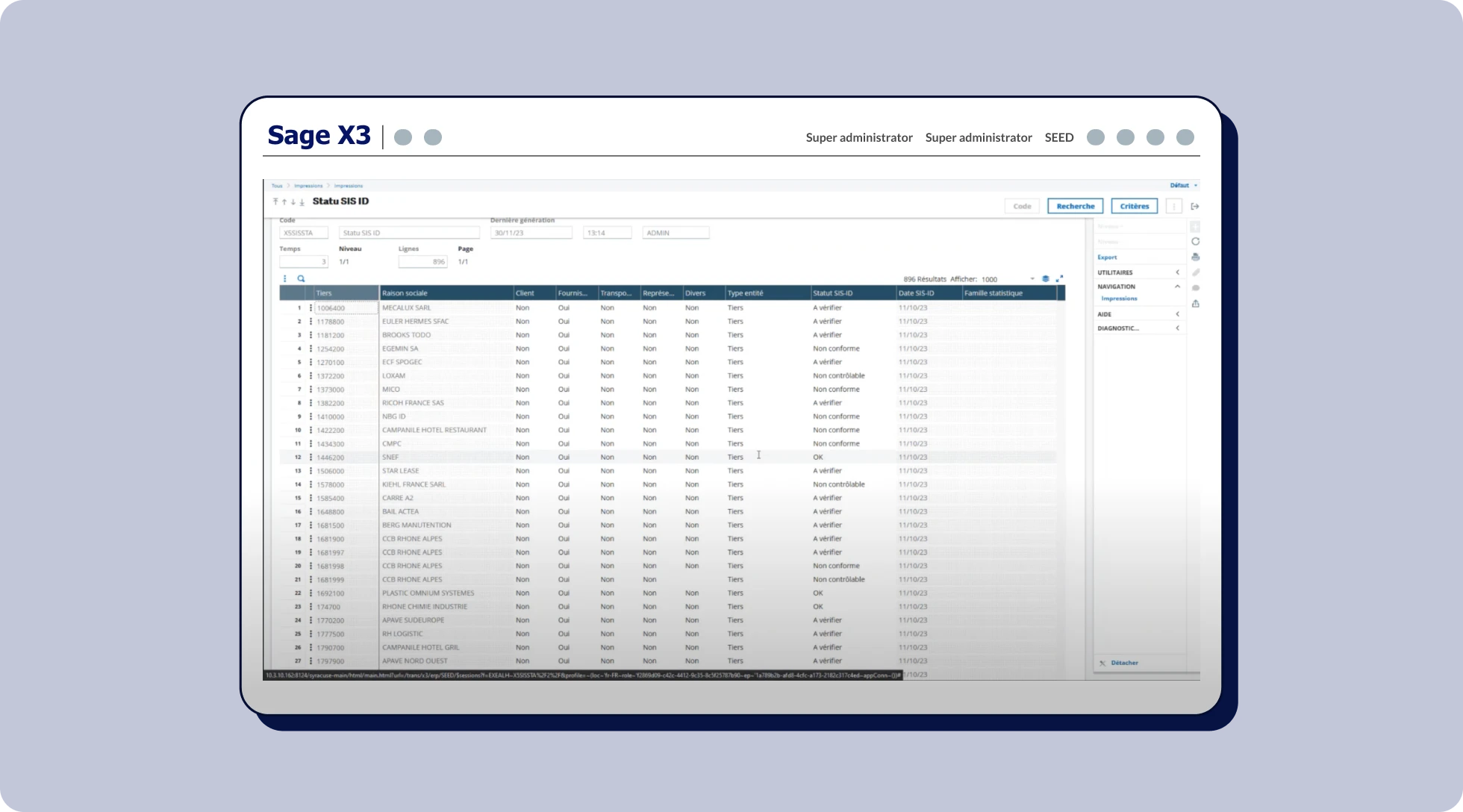

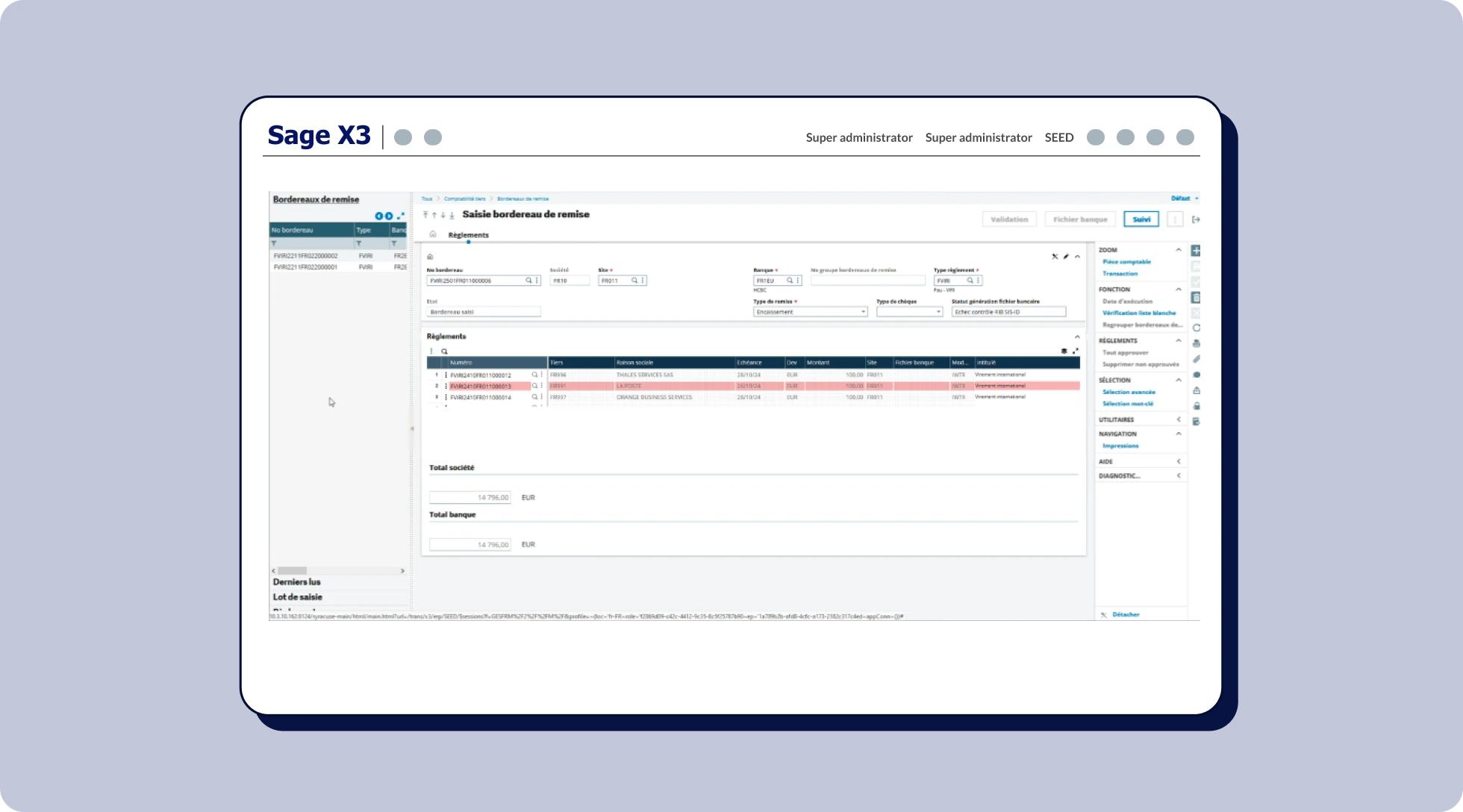

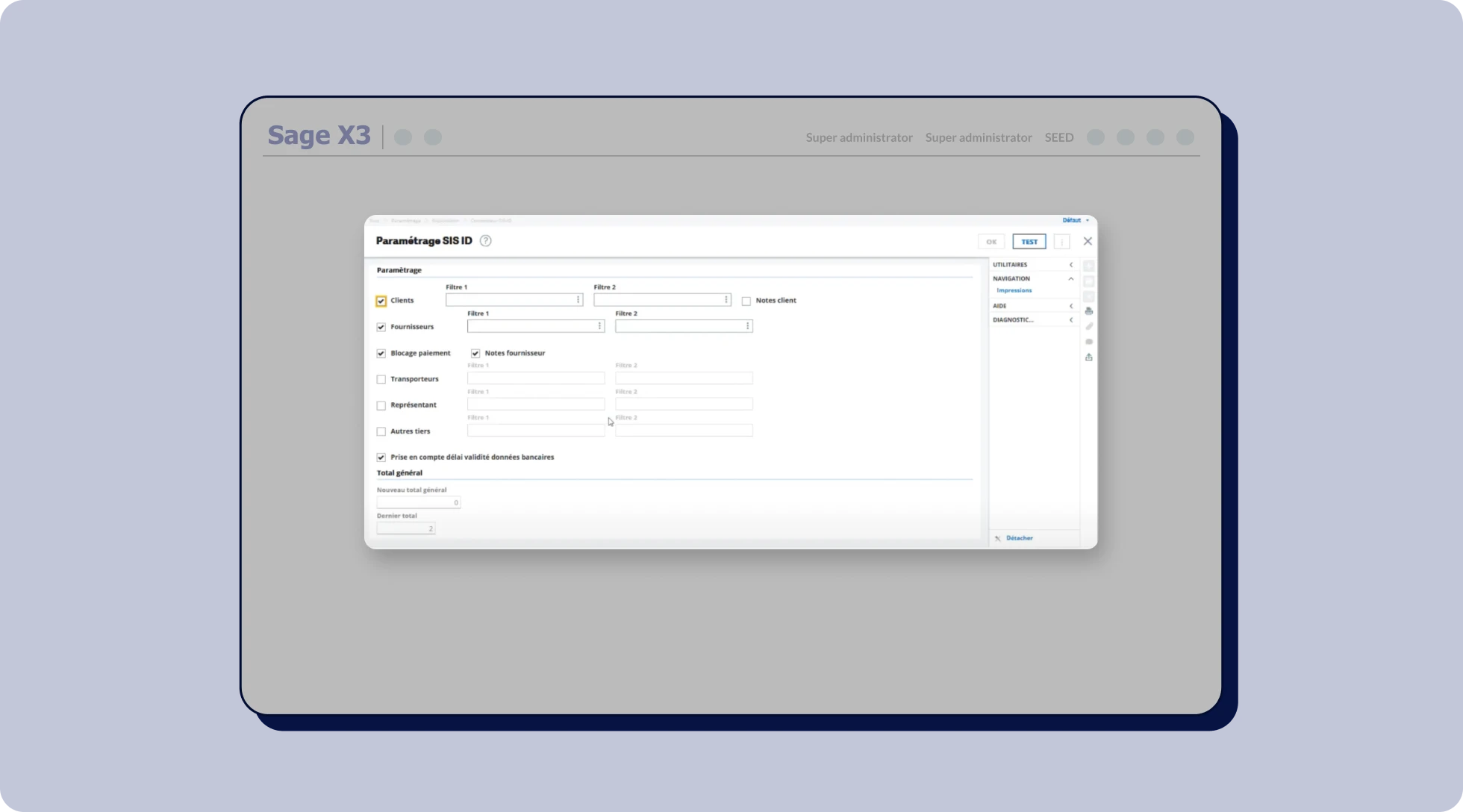

Protect your business from banking fraud with a shield directly integrated into your Sage X3 application through Sis Inside Sage X3 by SRA. From supplier record creation to payment issuance, easily verify your third-party bank details. With advanced configuration options, automate your checks and block payments if incorrect information is detected, securing every transaction.

What they say about us

"To meet the payment security needs of our Sage X3 clients, we developed a connector based on Sis ID's reliable and easy-to-integrate solution. It automatically verifies the SIRET/IBAN pair in real time—from third-party creation to payment—and integrates seamlessly with Sage X3 workflows."

Key features available