Prevent payment fraud directly from Kyriba

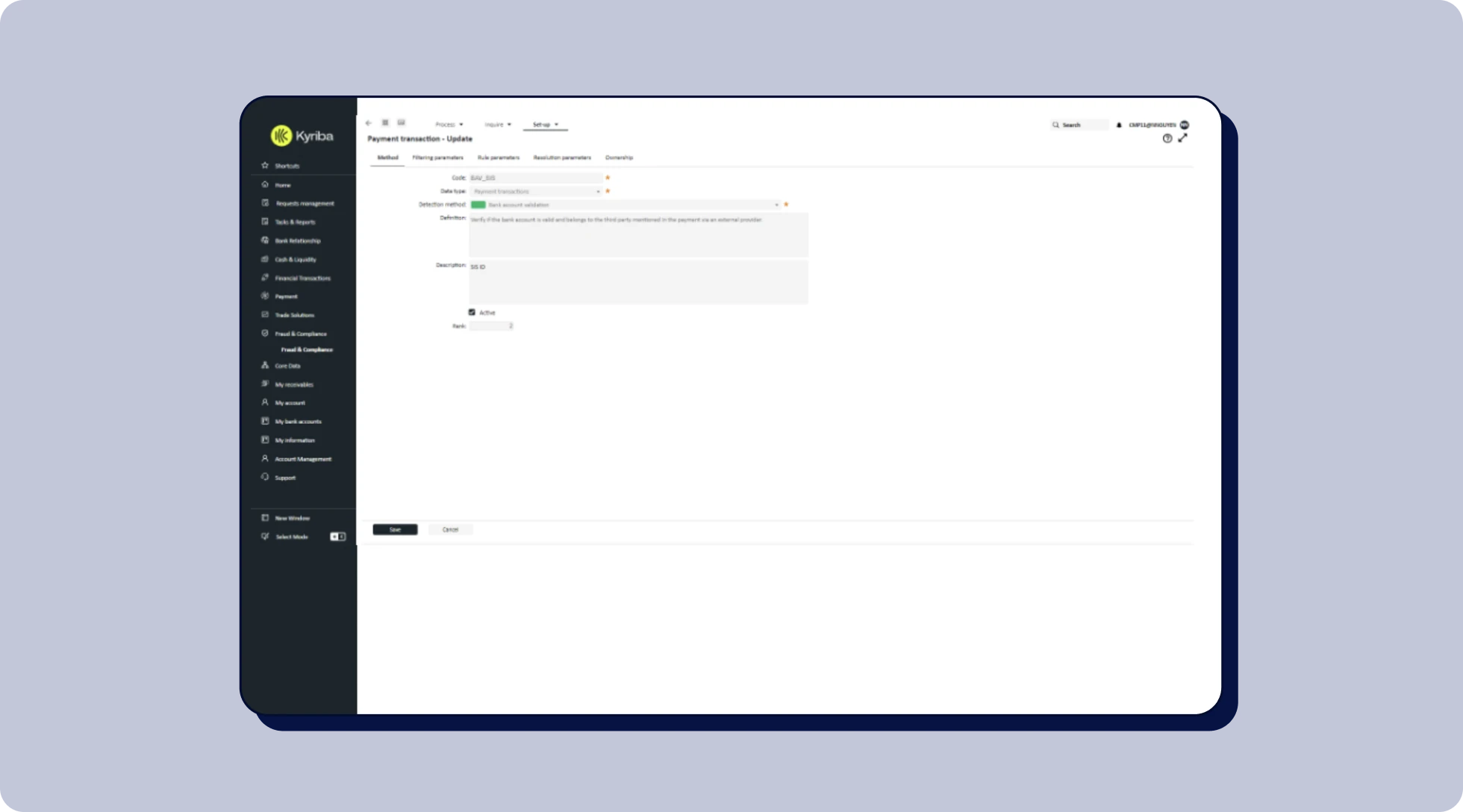

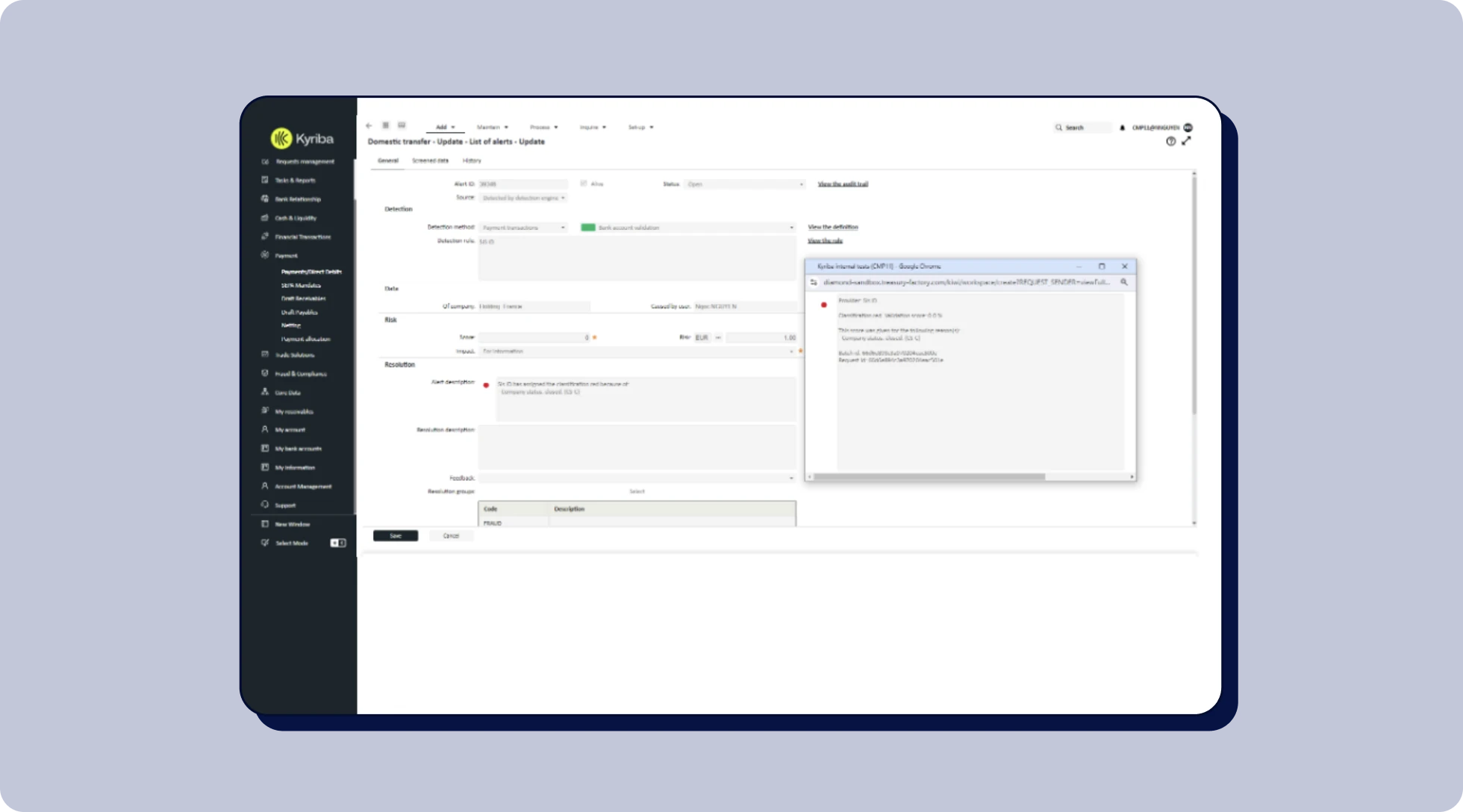

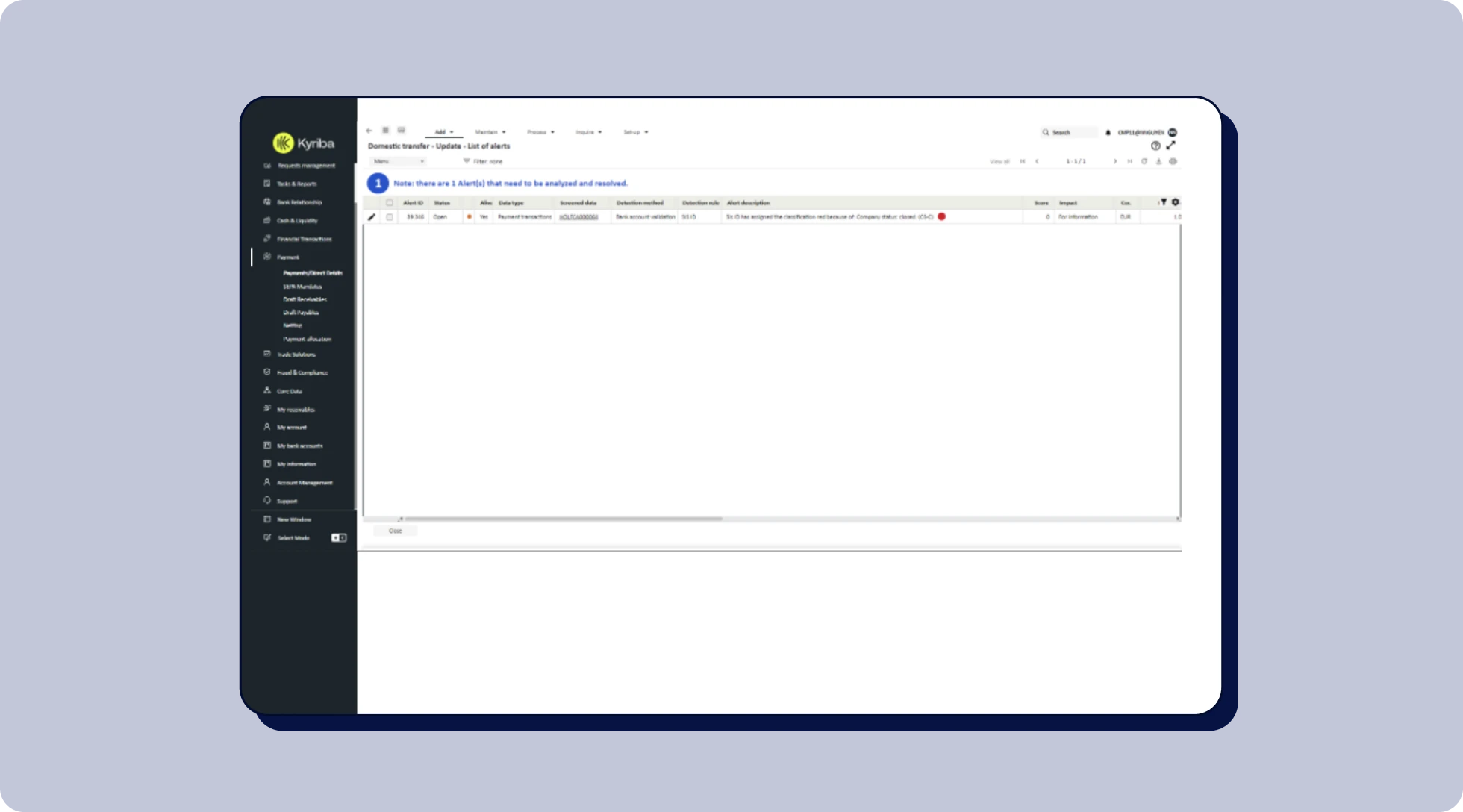

The Sis Inside Kyriba solution, available within the Fraud & Compliance module, automates the verification of your third parties' bank details (both individuals and legal entities) to secure your payment batches. It provides real-time protection and centralized risk management directly within Kyriba. In the event of fraud involving verified details, a financial loss guarantee is included with your Sis ID subscription, further enhancing the security of your payments.

What they say about us

"We chose to integrate Sis ID because they are pioneers in the IBAN/Name Check space, with a proven track record in payment data security. Their expertise and API-first approach made the integration seamless and allowed us to offer our clients a trusted solution to prevent fraud and ensure the reliability of beneficiary data directly within the Kyriba platform."

Key features available