Prevent payment fraud directly from Cegid XRP Ultimate

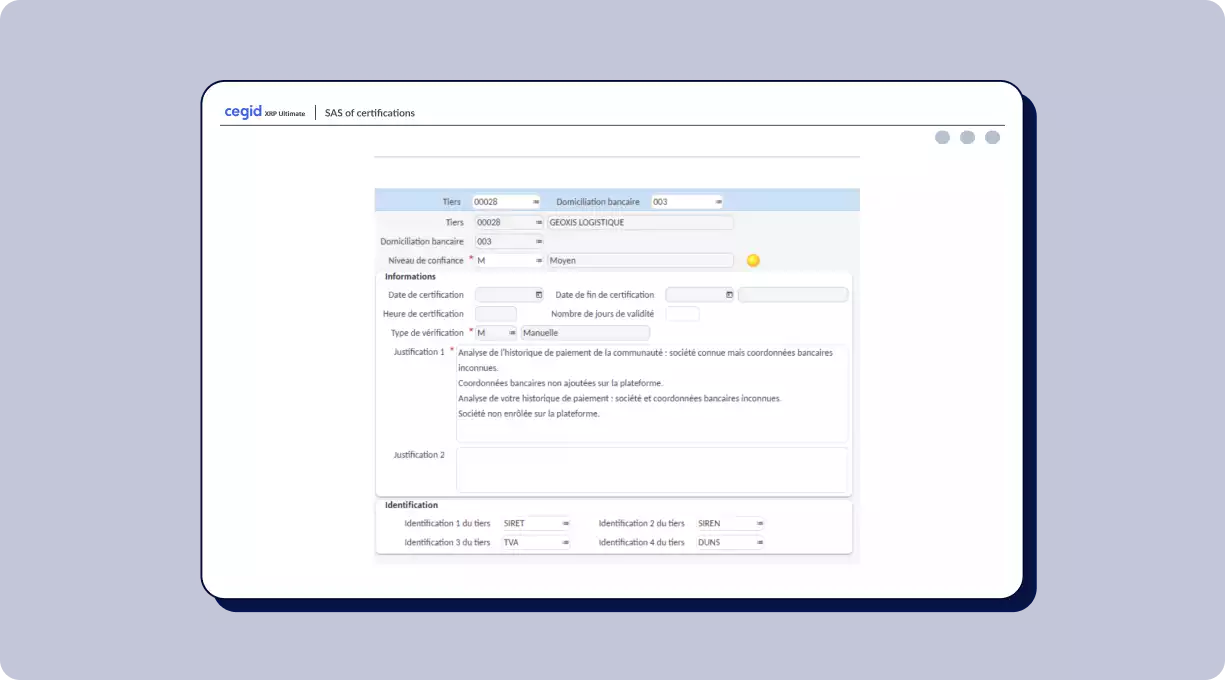

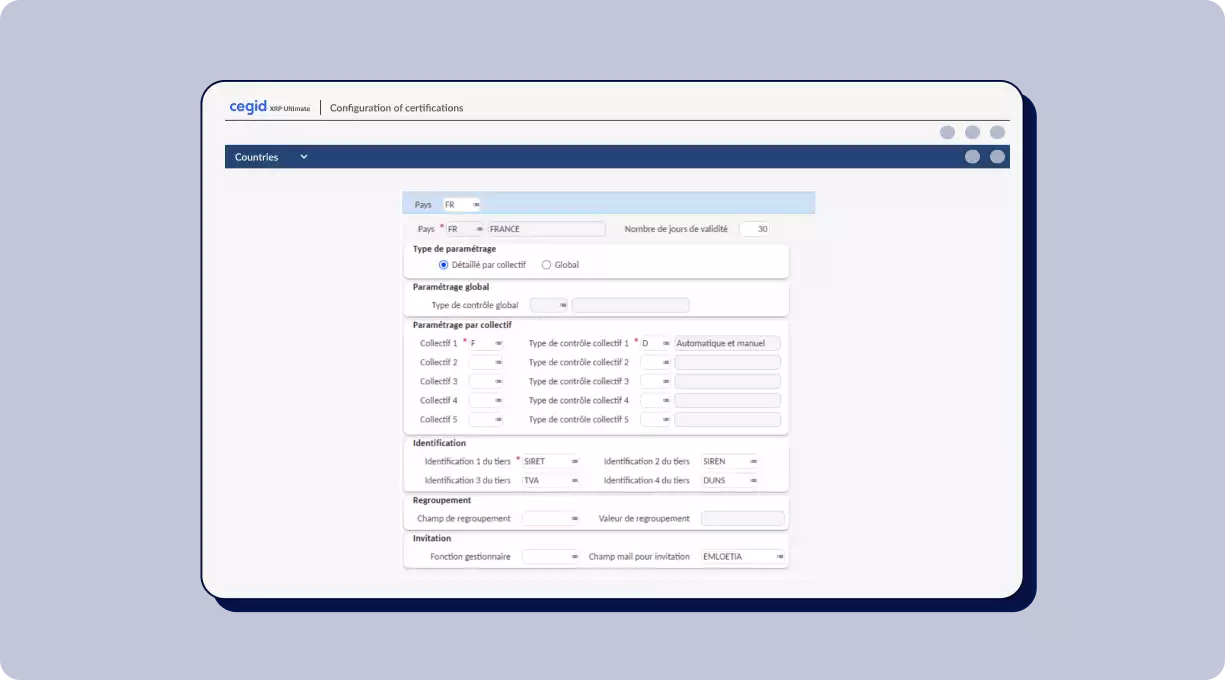

Protect your business from banking cybercrime within your Cegid XRP Ultimate application. The Sis ID solution enables you to verify the validity of your third parties’ bank details—both in France and internationally—directly from your treasury module. Beyond securing your payment decisions, Sis Inside Cegid XRP Ultimate speeds up your verification processes by alerting you in real time if any of your supplier payments carry a fraud risk.

What they say about us

"Our long-standing partnership with Sis ID enables us to develop solutions seamlessly integrated within the Cegid environment, providing our clients with an optimal user experience to secure their payment data. Close collaboration with the Sis ID teams helps us create tailored onboarding and training journeys that deliver real added value to our clients."

Key features available