Prevent payment fraud directly from Aprovall

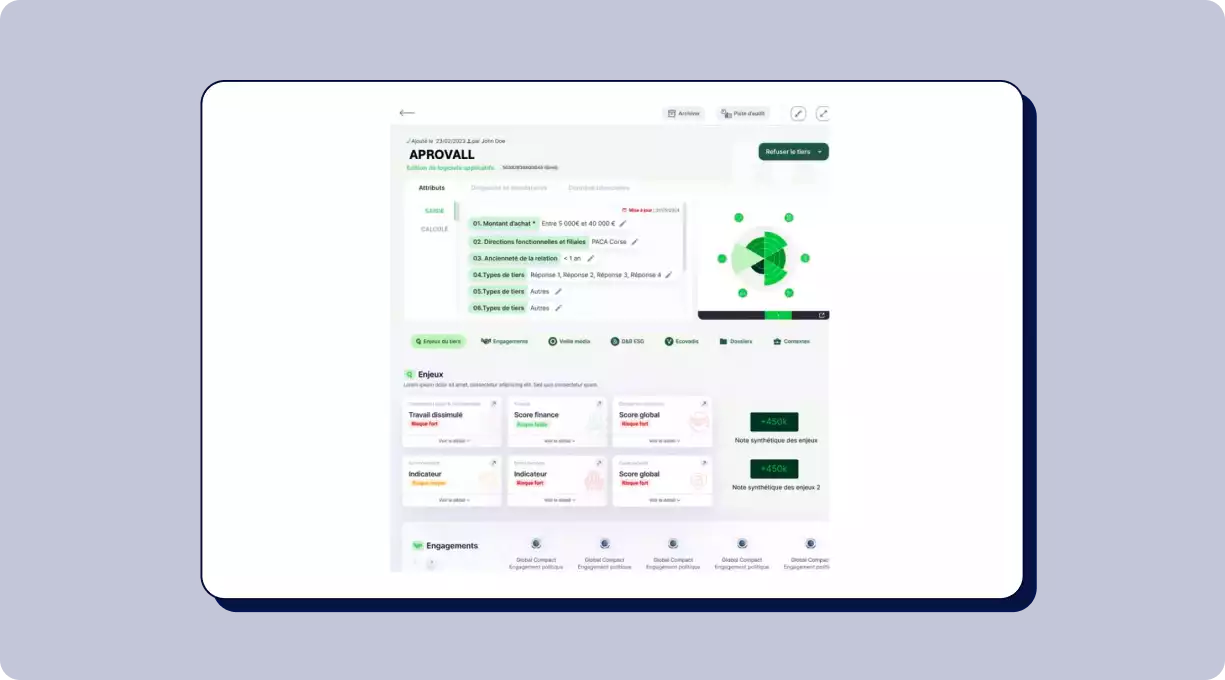

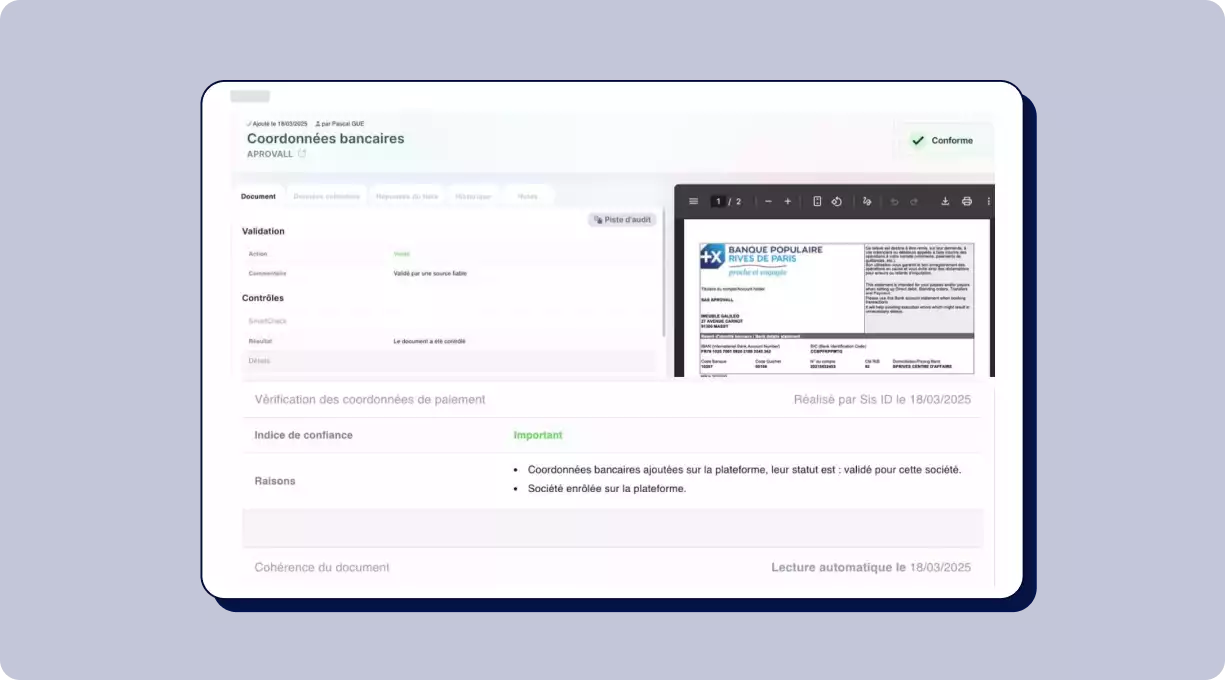

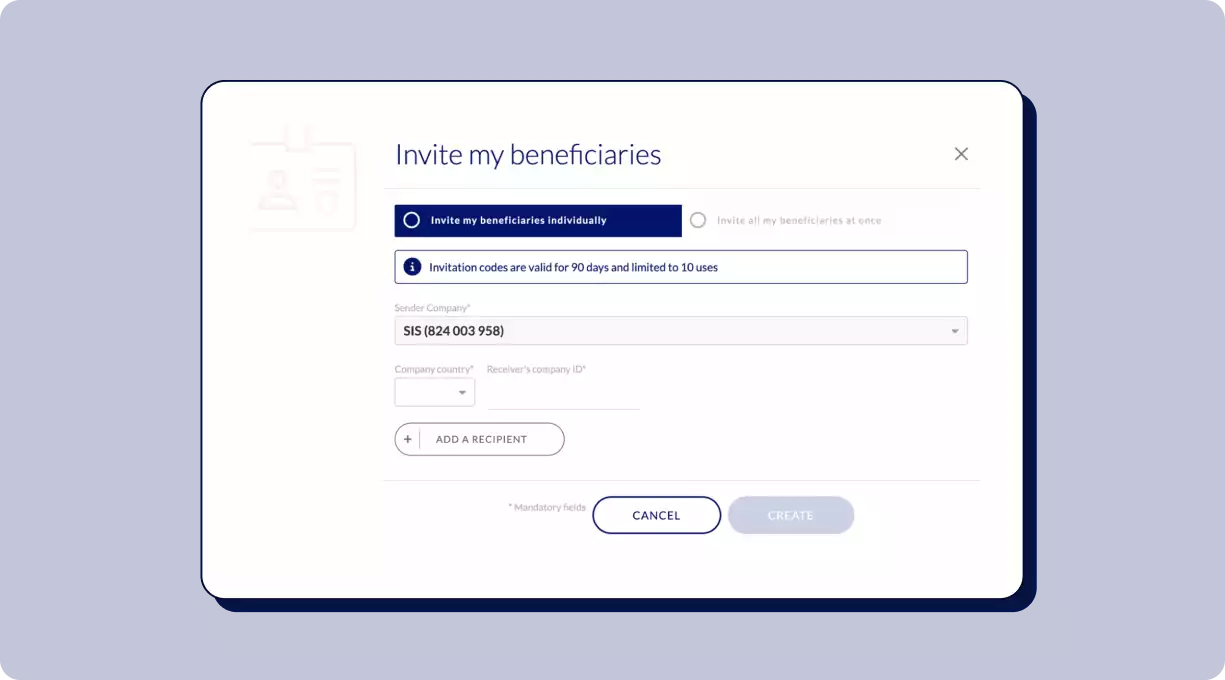

Fully integrated in the Aprovall platform, Sis ID verifies the validity of bank details collected on your third parties’ bank statements. Each check clearly indicates whether the account is correctly linked to the beneficiary, incorrect, or potentially fraudulent. Available in over 200 countries and territories, Sis ID enhances Aprovall’s TPRM assessment solution, enabling you to manage banking fraud risks from the very first stage of partner onboarding.

What they say about us

“The partnership with Sis ID is a natural and obvious choice, as it integrates seamlessly in our value chain. At Aprovall, we secure and simplify the collection and verification of suppliers’ compliance documents, but one critical element was missing: the ability to verify the connection between a supplier and their bank account. This verification represents Sis ID’s core expertise, and they are now bringing this unique capability to our solution. Aprovall now embraces the complete bank assessment process by alerting managers about the bank account compliance and eases enterprises to reduce the bank account fraud. ”

— Emmanuel Poidevin, Founder & CEO of Aprovall

Key features available