Prevent payment fraud directly from Cegid Allmybanks

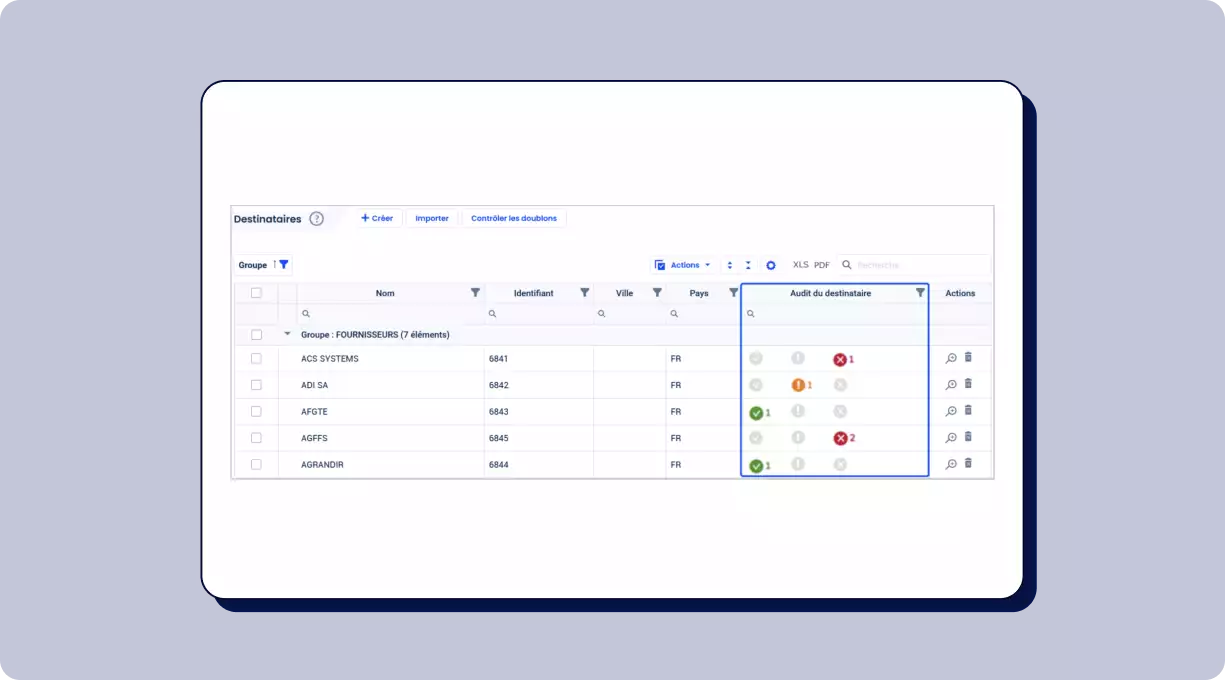

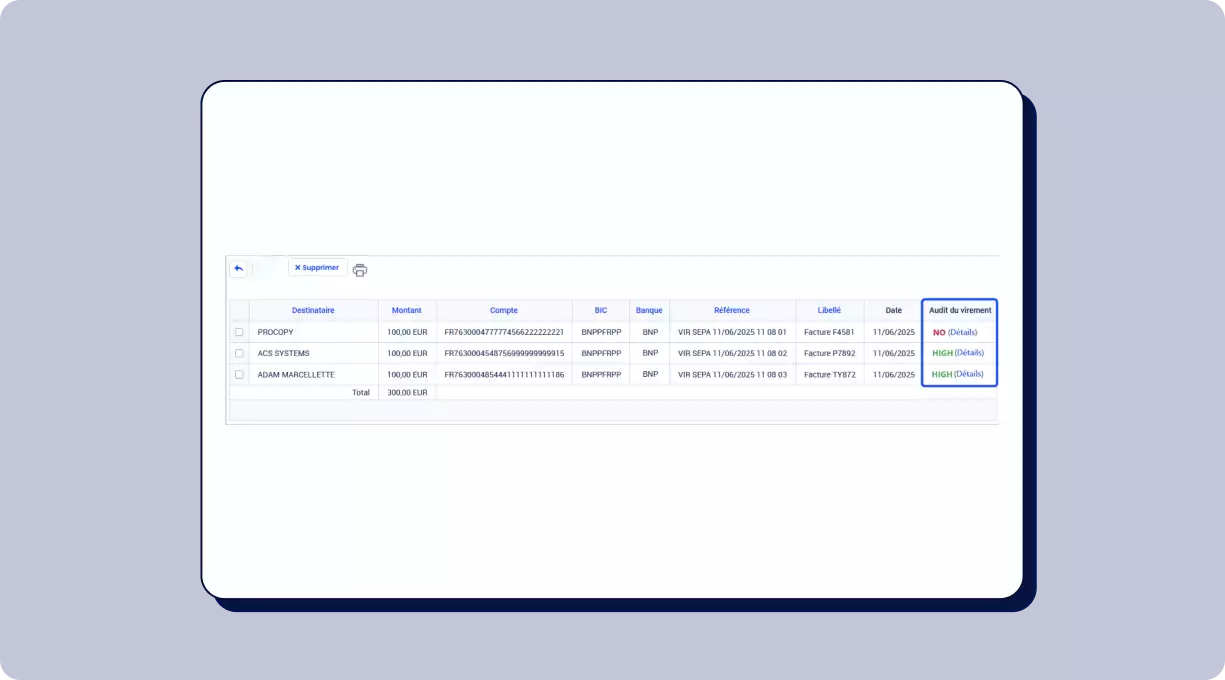

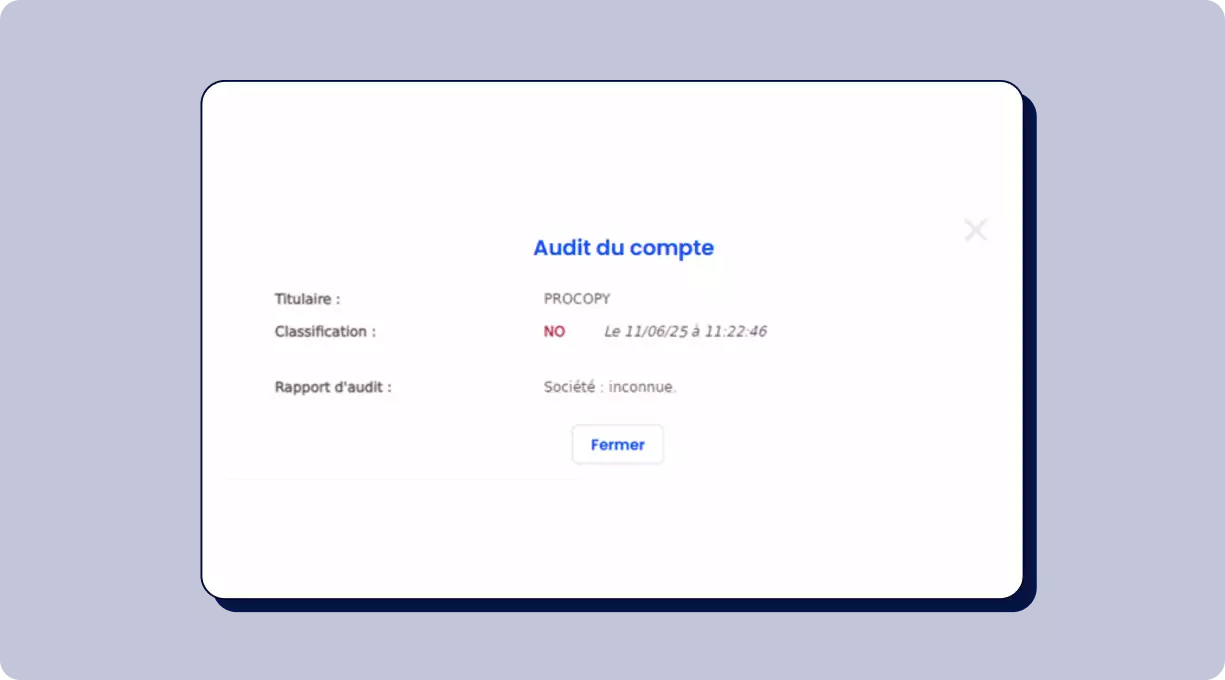

Sis Inside Cegid Allmybanks integrates directly into your payment validation workflows to secure banking flows at every stage. It validates beneficiary bank details at creation, during targeted audits, and before payment execution, instantly flagging incorrect or fraudulent data. Fully embedded in Cegid Allmybanks, the solution is quick to activate without development, provides detailed reasons for each check, and generates a timestamped audit trail for full compliance.

What they say about us

"Our long-standing partnership with Sis ID enables us to develop solutions seamlessly integrated within the Cegid environment, providing our clients with an optimal user experience to secure their payment data. Close collaboration with the Sis ID teams helps us create tailored onboarding and training journeys that deliver real added value to our clients."

Key features available