Integrate Sis ID into your Esker account

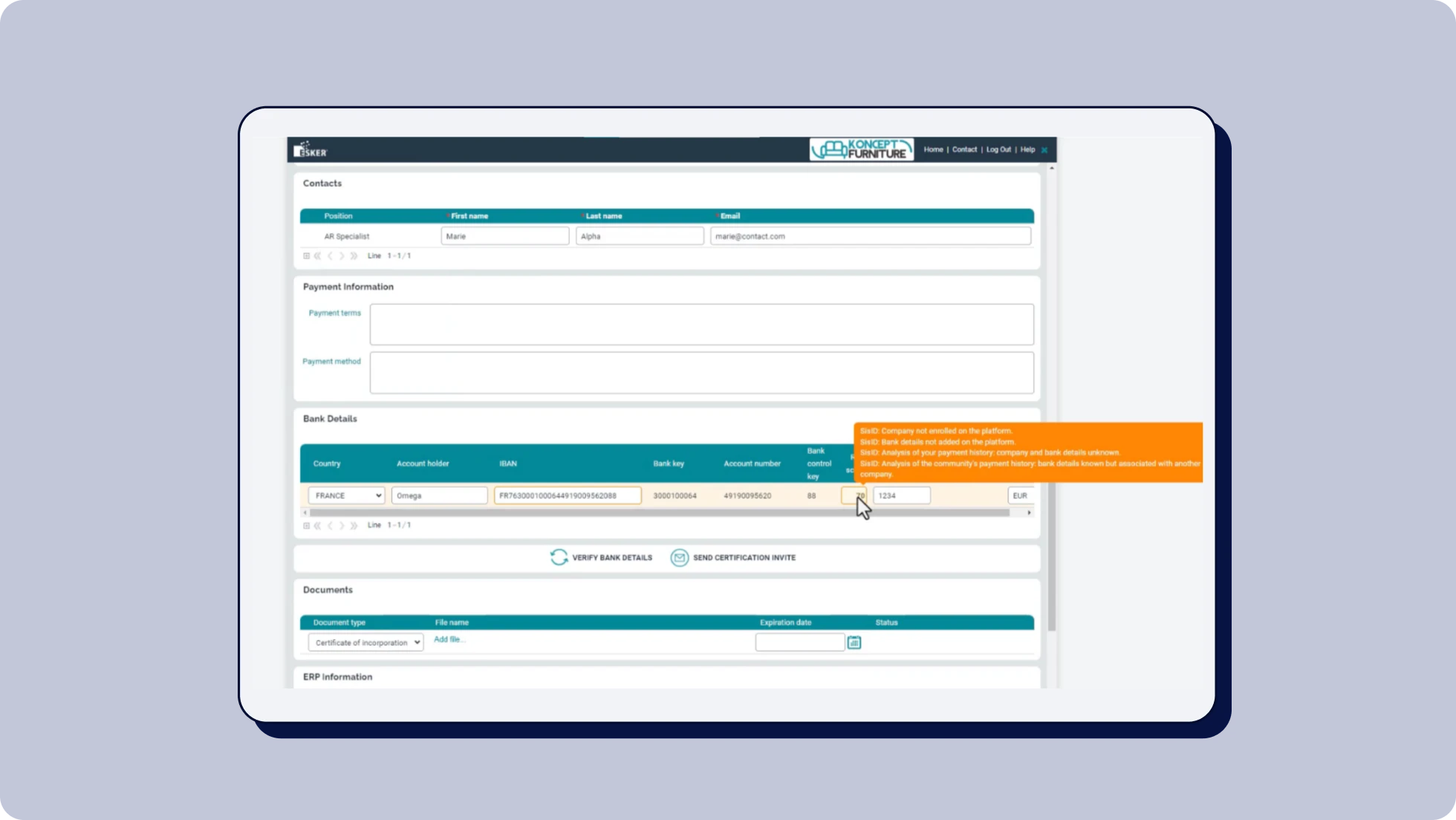

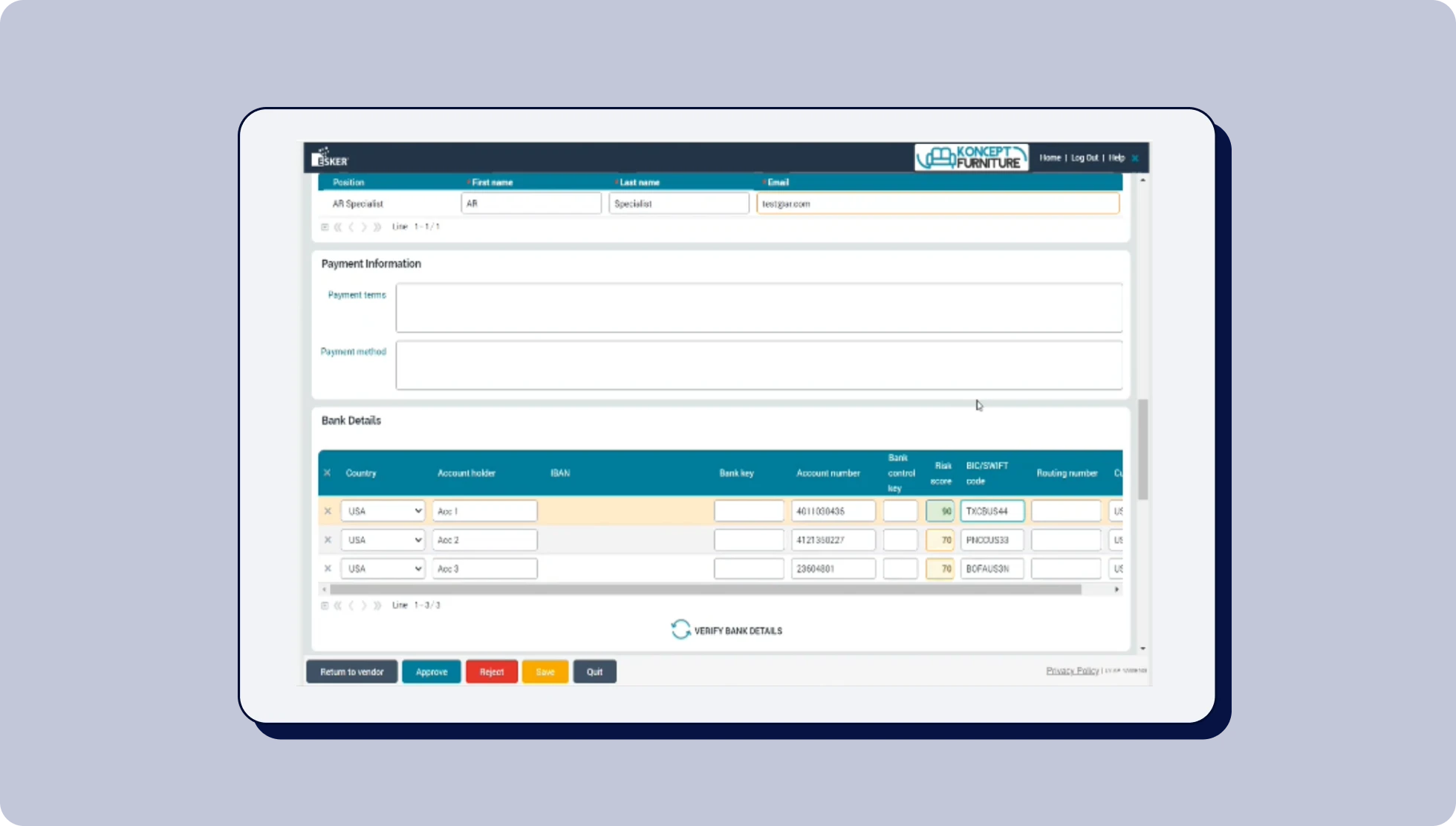

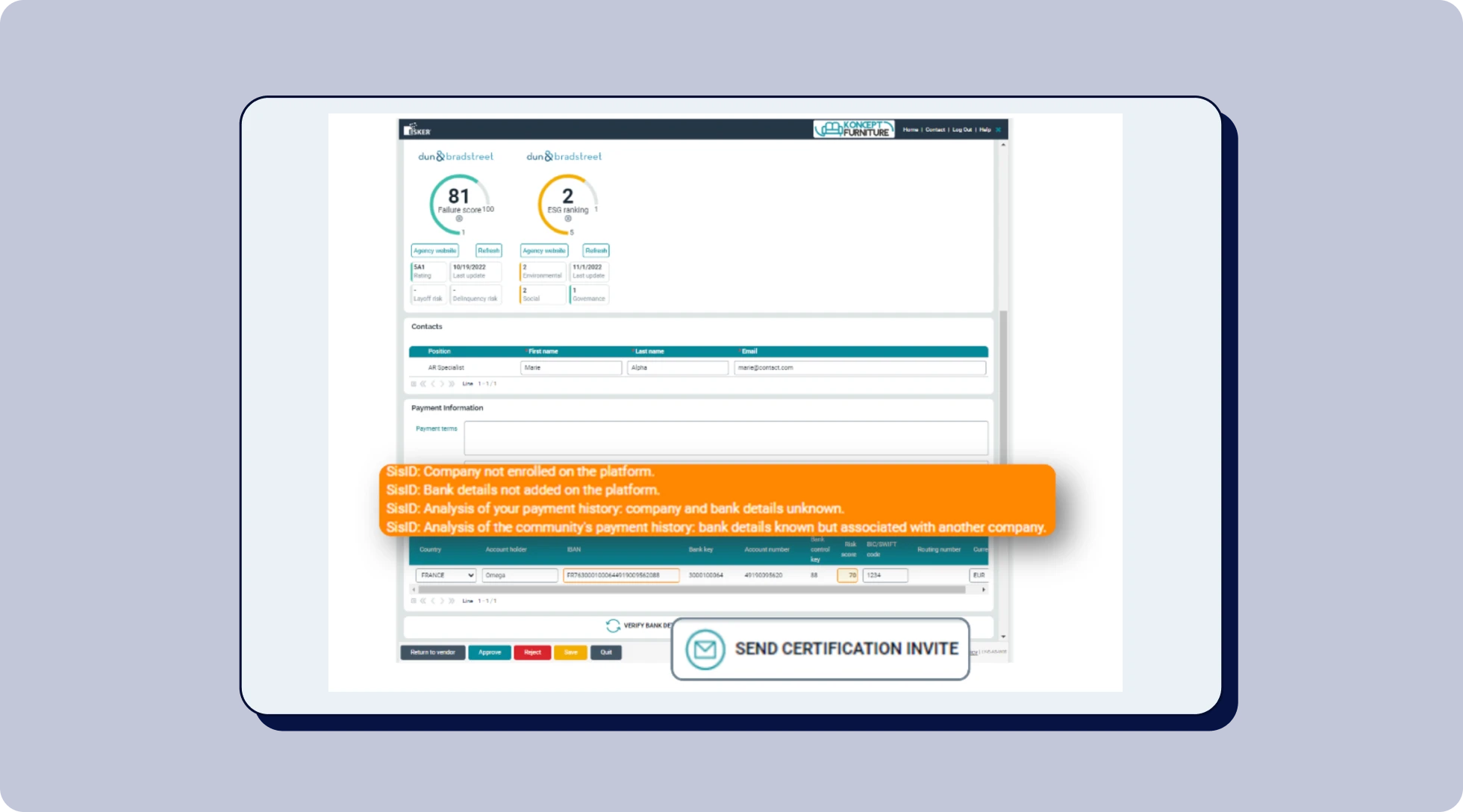

Fully integrated into Esker’s Source-to-Pay suite, Sis Inside secures payments and simplifies third-party management. Connected to Esker’s supplier portal, it gives businesses greater control over their transactional data — helping reduce fraud and support financial digitalization. With Sis ID embedded, only verified bank accounts are approved, ensuring secure payments. Together, Esker and Sis ID offer a single, centralized environment that protects against fraud while streamlining supplier onboarding and payment processes.

What they say about us

“We decided to integrate Sis ID into our solution because it felt like a natural fit: as a French fintech, it shares our ecosystem and mindset; we had established relationships with their leadership team, which made collaboration easy; the integration was driven by a client request; and from a technical and business standpoint, working with Sis ID has been smooth thanks to their clear API and accessible team.”

Key features available