Prevent payment fraud directly from FIS Payment Hub

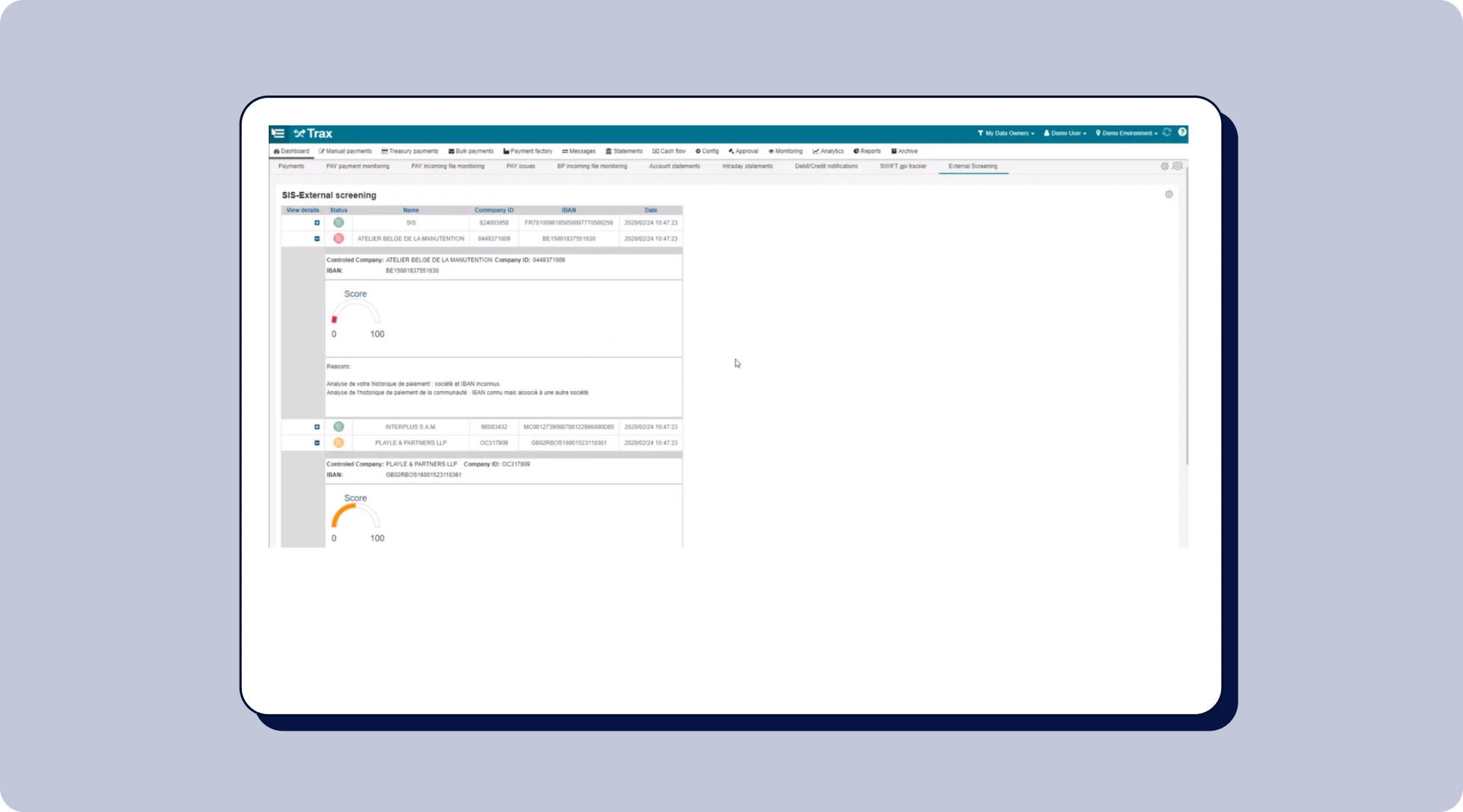

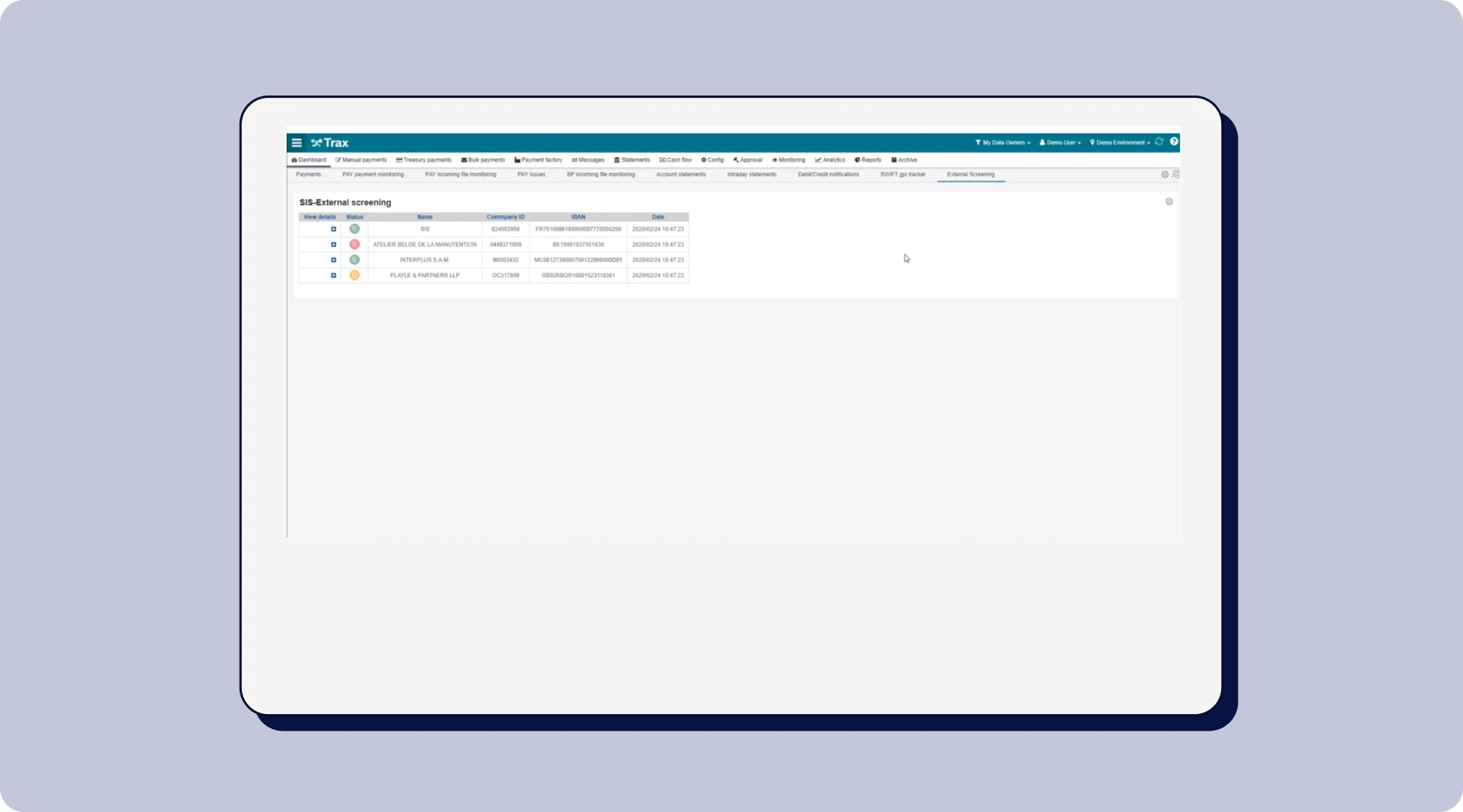

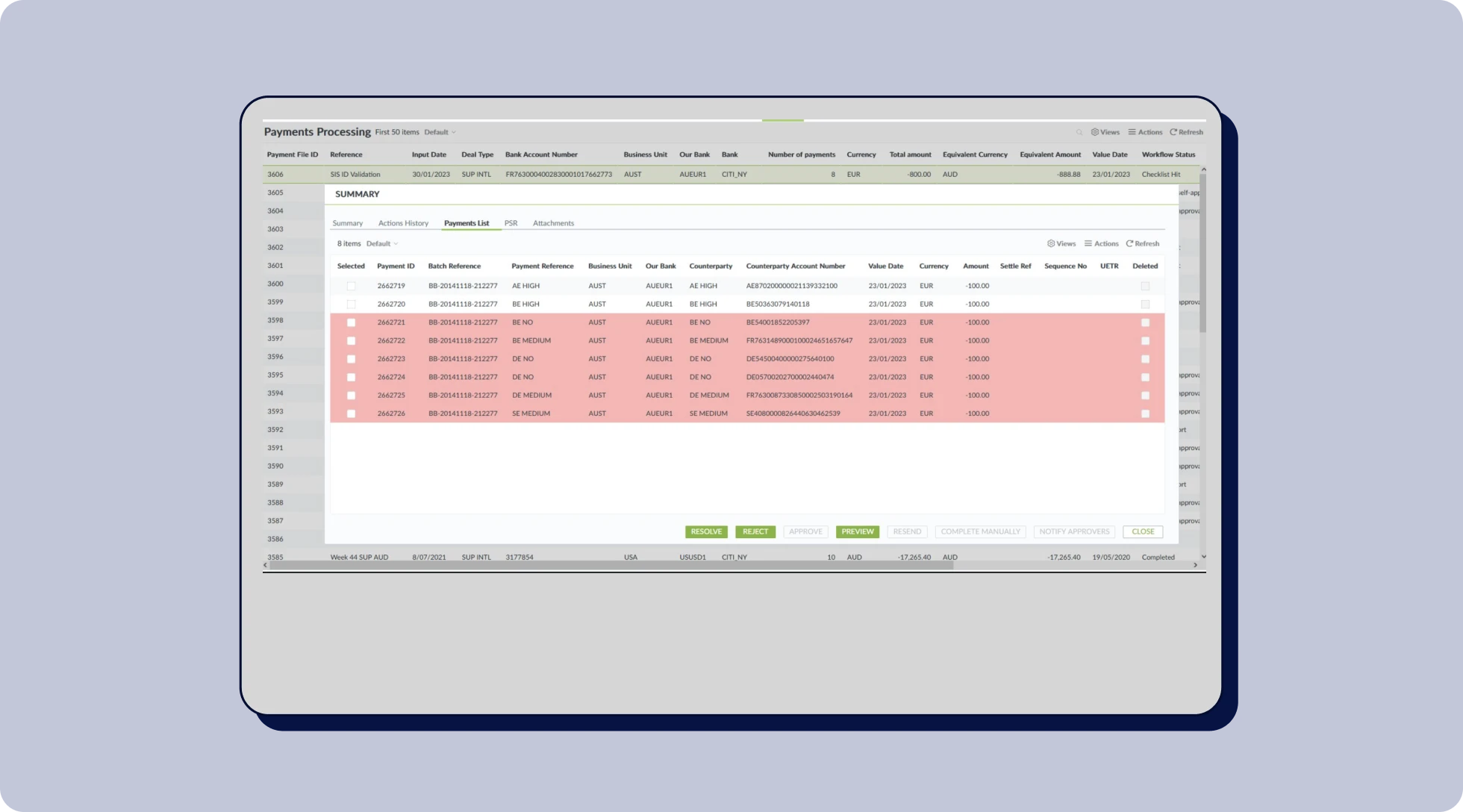

Sis Inside FIS Payment Hub automates the validation of your third parties’ bank details to secure your payments. By integrating your lists of authorized or restricted beneficiaries, the solution ensures compliance and accurately flags payments at risk of fraud or bank rejection. What’s more, your subscription includes financial loss coverage — protecting you in the event of fraud involving beneficiaries and bank details validated by Sis ID.

What they say about us

“With FIS Fraud Service powered by Sis ID, we offer our clients an integrated and innovative fraud detection solution that helps them mitigate payment fraud globally. What truly sets Sis ID apart is the quality of their support. Their teams work closely with us and our clients to ensure fast and seamless deployment — and the feedback from our customers has been overwhelmingly positive.”

Key features available