Prevent payment fraud directly from Diapason

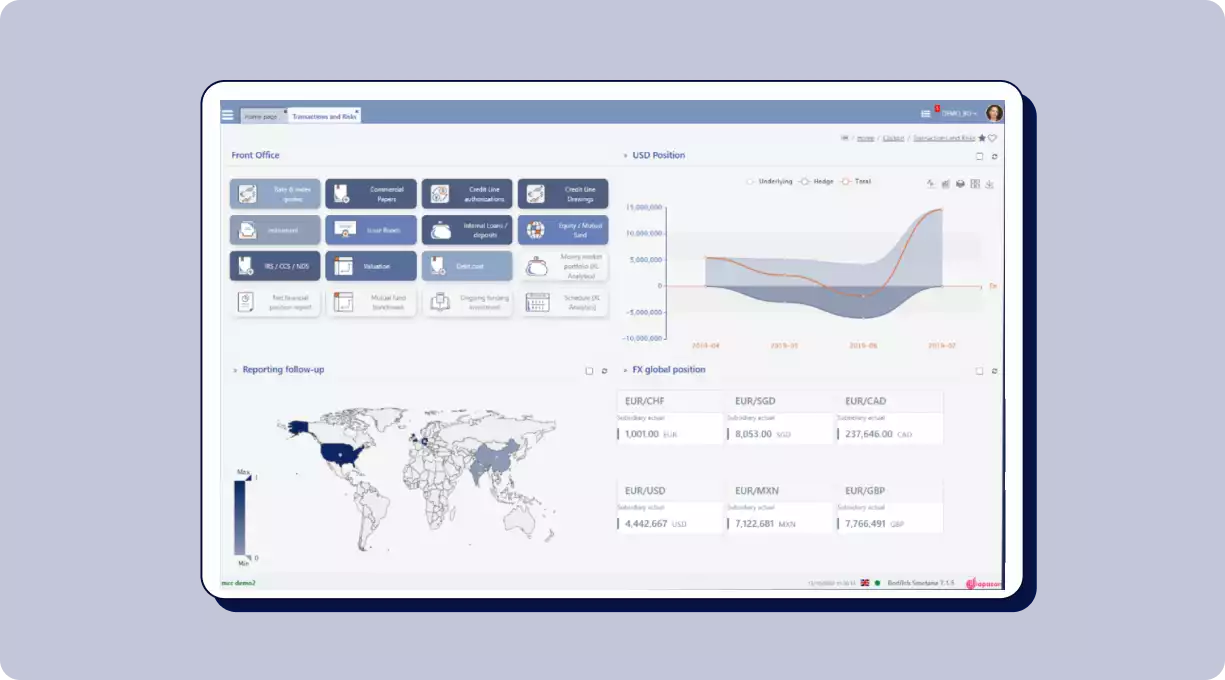

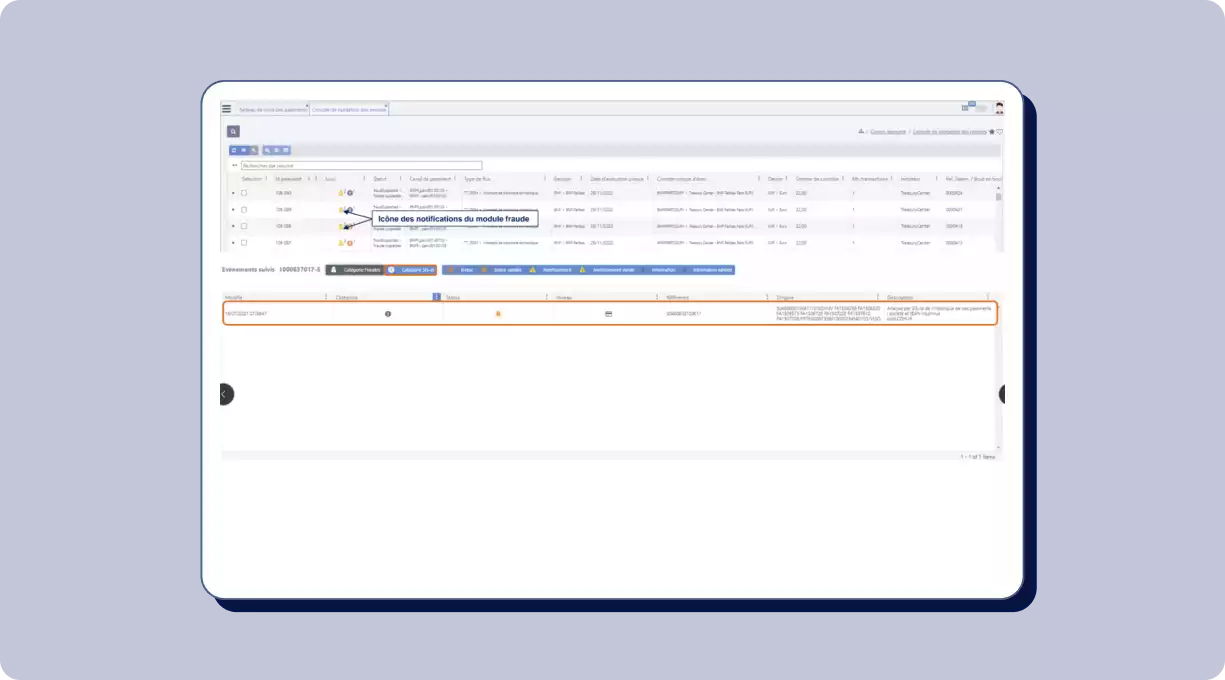

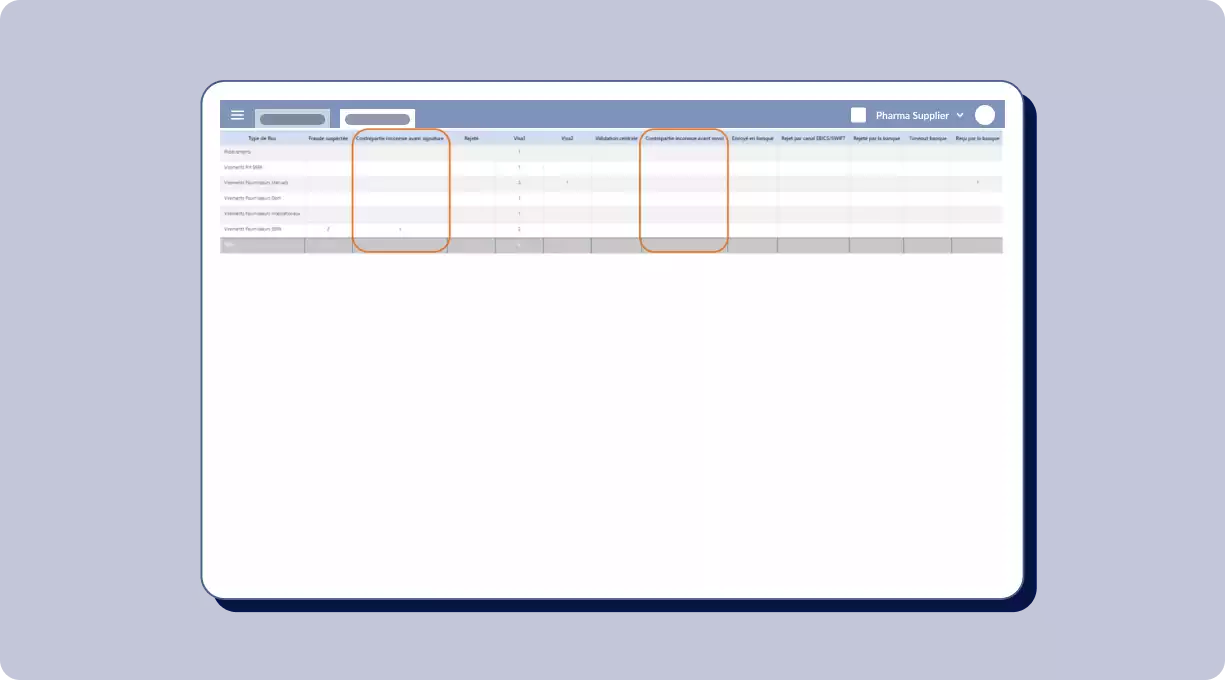

Sis Inside Diapason integrates directly into myDiapason’s Payment workflow to automate anti-fraud checks by validating the match between beneficiaries and bank details before each payment. Thanks to native integration, the solution is easily deployed with no additional development required. It provides real-time, centralized risk management within myDiapason and includes a financial loss guarantee in case of fraud involving beneficiary/bank detail pairs validated by Sis ID.

What they say about us

“We chose to integrate Sis ID into myDiapason solutions to provide our clients with a 360° view of payments and beneficiaries. By combining our two solutions, treasurers gain peace of mind: checks are automated and seamlessly integrated into their workflow, ensuring maximum security every day.”

Key features available