Prevent payment fraud directly from Geoficiency

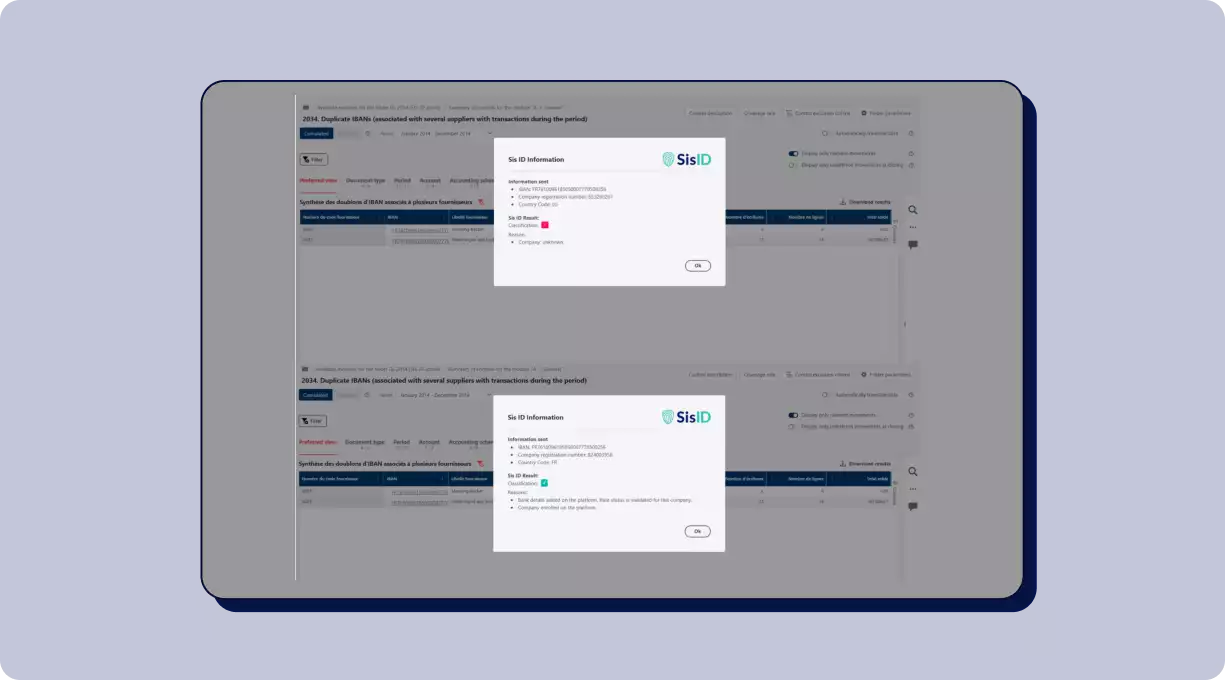

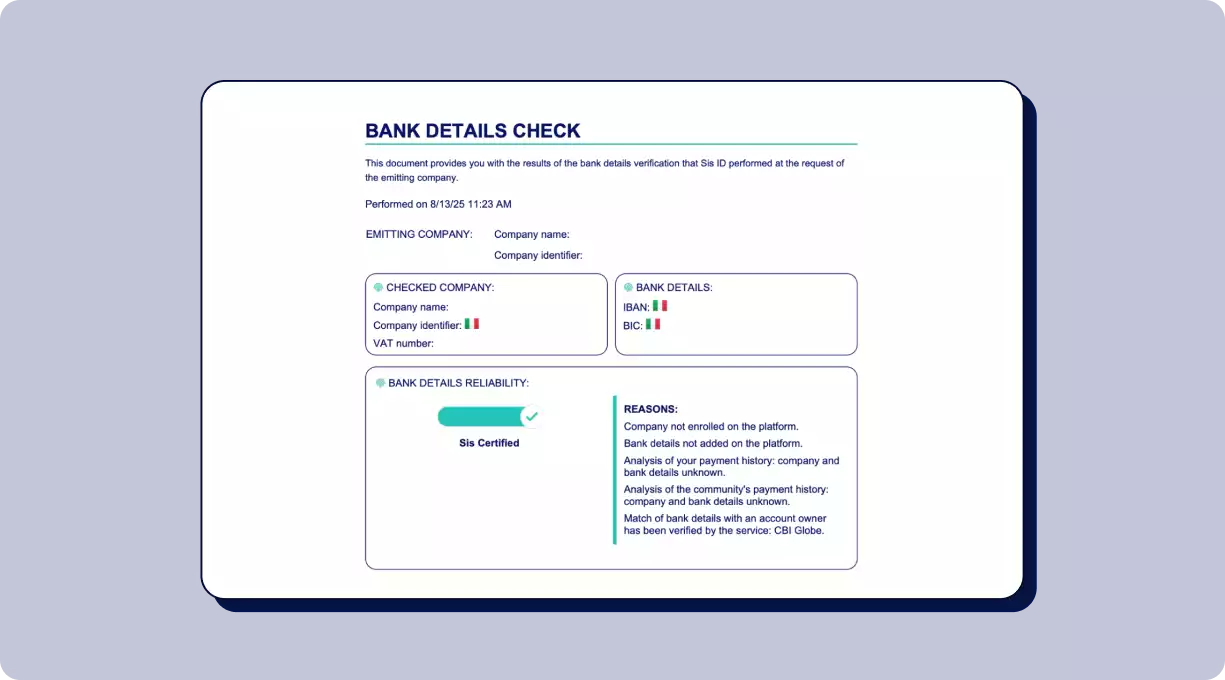

Sis Inside Geoficiency enhances the power of your accounting investigations by validating the reliability of bank details used for payments. It instantly flags anomalies and provides clear, detailed reasons for each verification result, enabling you to focus only on relevant cases. By simplifying investigations and strengthening operational compliance, Sis Inside Geoficiency helps ensure secure, accurate, and regulation-aligned payment processes.

What they say about us

"Faced with the growing risk of banking fraud, integrating a control mechanism into Geoficiency was a natural step for us. As a market leader with a high-quality solution, Sis ID quickly emerged as the ideal technology partner, especially since we already shared common clients. Additionally, the robustness of Sis ID's APIs and the support from their teams enabled us to launch the project rapidly, meeting the needs of several shared clients requesting the connector."

Key features available