Prevent payment fraud directly from OpenCash

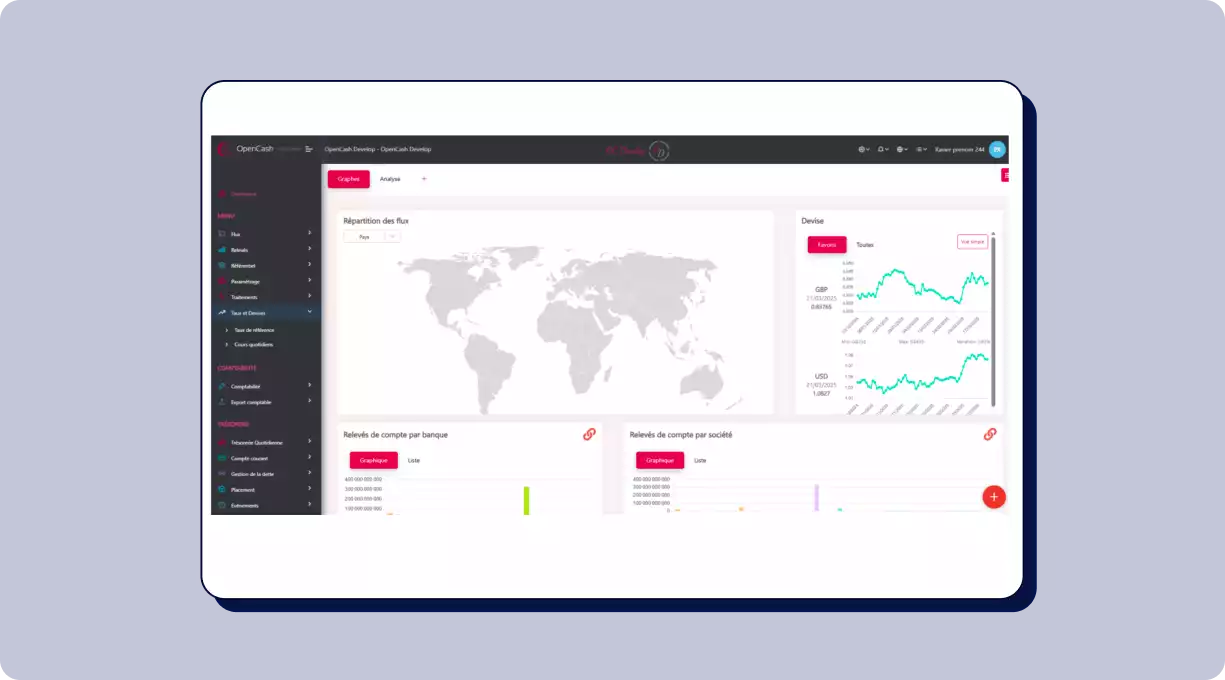

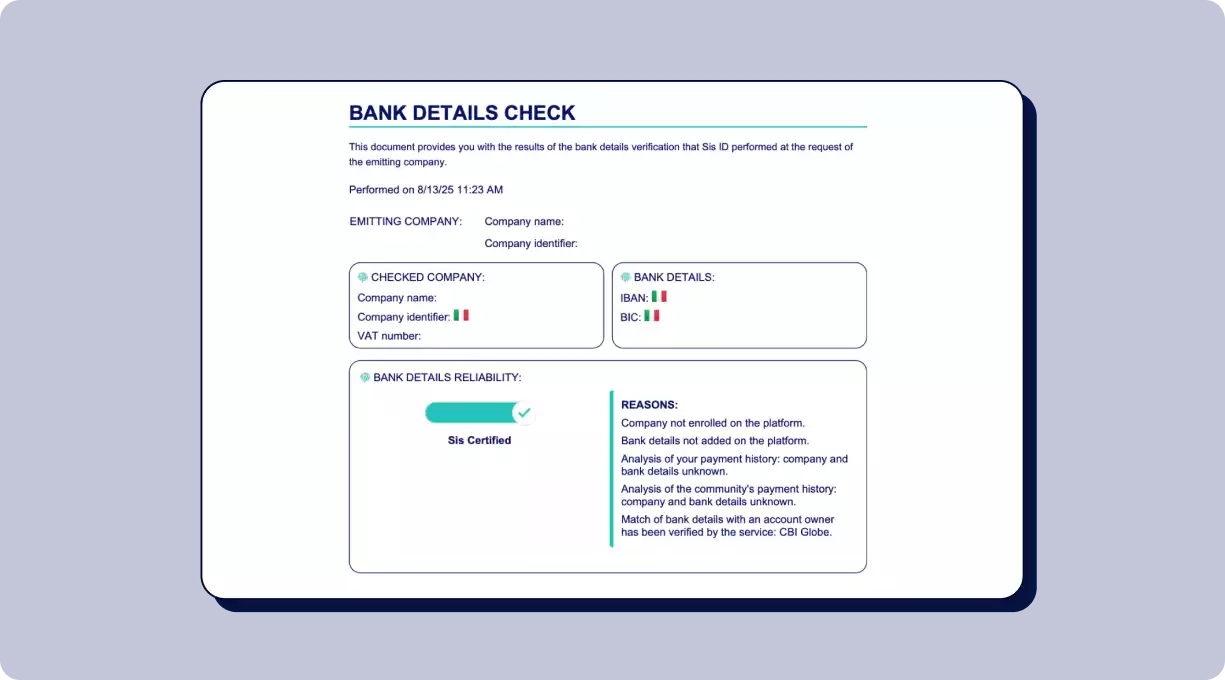

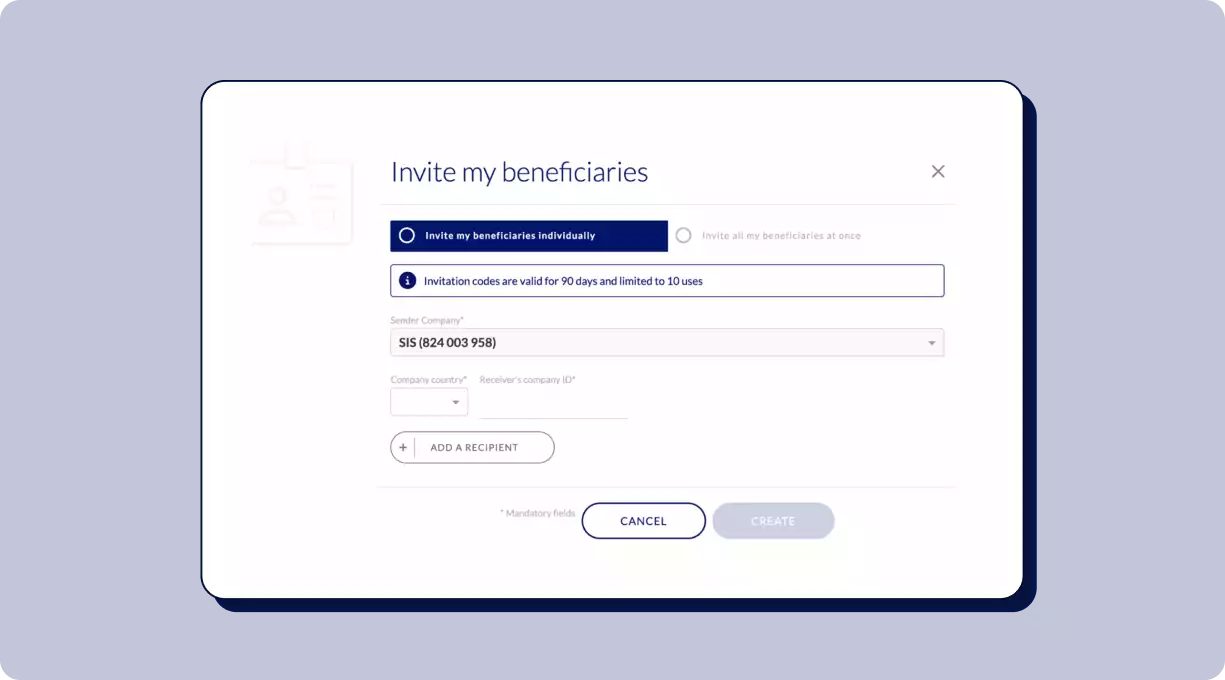

Sis Inside OpenCash streamlines the verification of third-party bank details directly within OpenCash, securing every payment flow. Beneficiary information is validated at onboarding, during audits, and prior to payment execution, instantly highlighting incorrect or potentially fraudulent accounts. When automatic verification is inconclusive, third parties can have their accounts certified by Sis ID experts. With global coverage, clear explanations, and timestamped audit trails, teams can work confidently, save time, and ensure accurate, secure payments.

What they say about us

“Sis ID perfectly complements OpenCash by giving our clients continuous assurance that their payment information is accurate. Teams benefit from greater efficiency and security, and the built-in fraud coverage is a real plus for keeping users’ transactions safe.”

Key features available