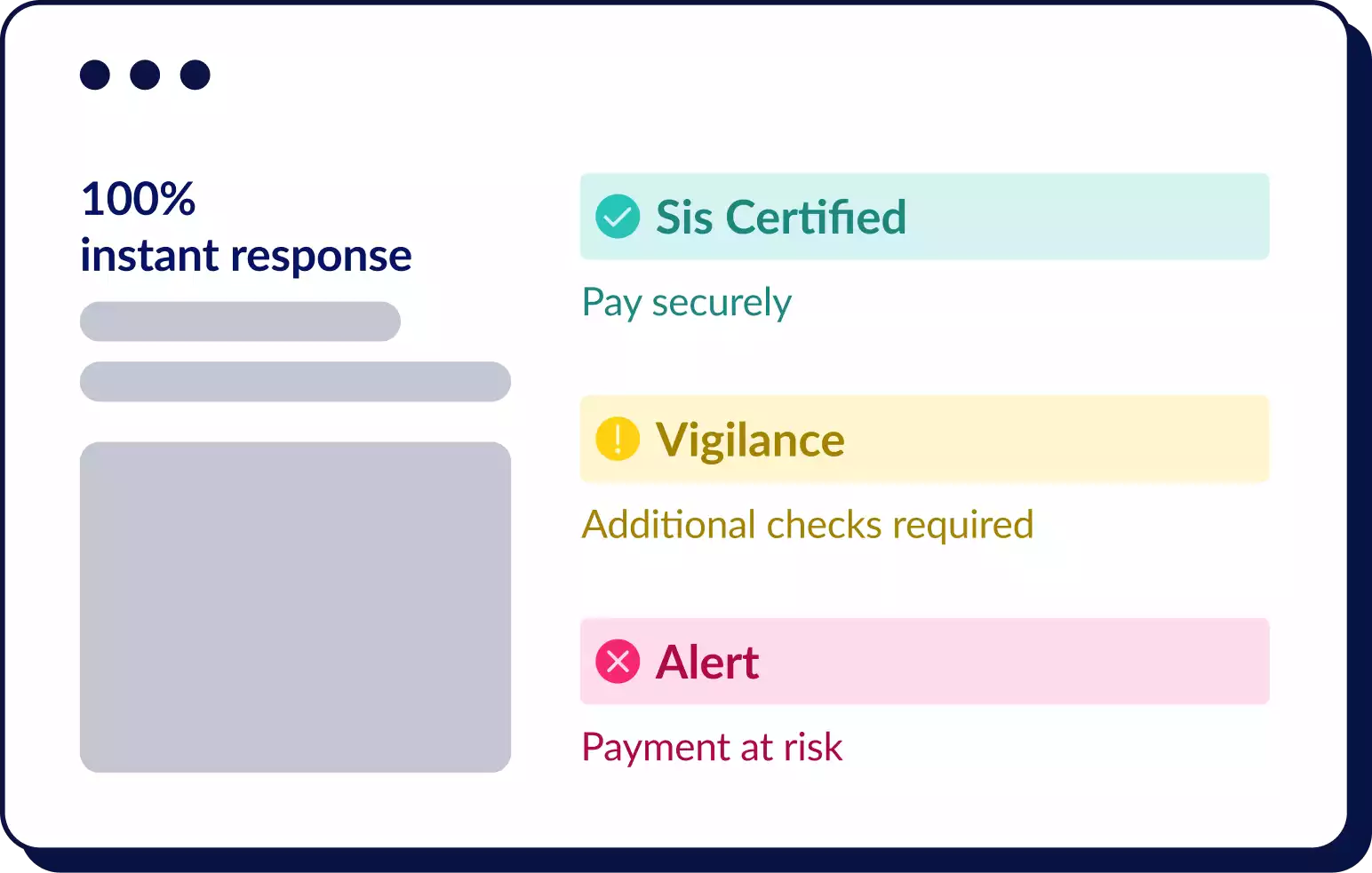

Pay with confidence and on time

Banking fraud is a major operational risk for corporates (financial losses, damaged solvency, reputational risks, etc.). Fraud attempts are increasing, and the sophisticated techniques used by fraudsters make them harder and harder to detect. To secure their liquidity, companies need to be cautious before each payment.

With Sis ID, companies secure their operations and are guaranteed to pay the right payee on the right bank account, while eliminating time-consuming and unreliable manual checks.

A few words from VINCI Construction France