Stay one step ahead of your new challenges with Sis ID

Faced with a rapidly changing banking landscape (increased risk of fraud, digitalisation, new regulations, etc.), financial institutions need to adapt in order to remain competitive. As a recognised expert in the fight against fraud thanks to its pioneering bank details verification technology, Sis ID offers several solutions to improve your customers’ experience while helping you strengthen your security processes.

Strengthen your advisory position and offer your customers an unrivalled payment experience

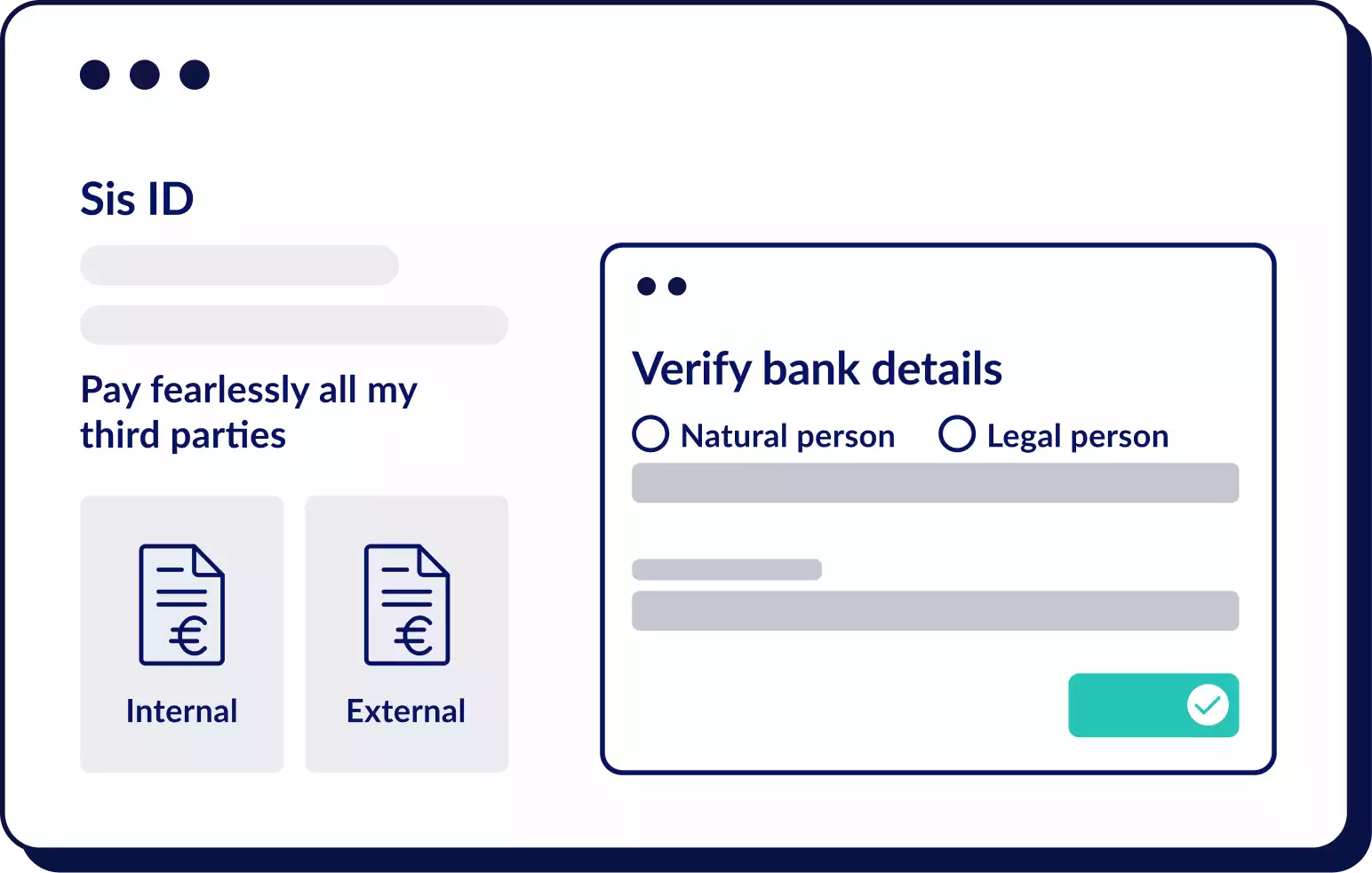

Thanks to Sis ID, your customers save precious time by automating the verification of their third-party bank details, reducing the risk of transfer fraud, bank rejections and manual input errors.

- Meet your customers’ cash-flow security needs while enabling them to streamline their Purchase-to-Pay chain.

- Develop an additional source of income by advising your customers on Sis ID and benefiting from commission on business brought in

- Enhance your customers‘ and employees’ knowledge of bank fraud issues through tailor-made training courses run by Sis ID experts

Control your banking fraud risks

Bank fraud is on the increase, leading to disputes between banks and the customers who are victims, even if the latter are negligent. In this context, Sis ID makes it possible to reposition the risks and responsibilities on the originators and simplifies the resolution of disputes.

- Help your customers control the risk of fraud by systematically checking their beneficiaries’ bank details with Sis ID.

- Improve the traceability of the transactions of your customers using Sis ID with a control history and audit trails available for each verification.

- Reduce refund disputes by offering your customers peace of mind with Sis ID: a unique insurance policy covers financial losses in the event of fraud on payments made to bank details validated as reliable by Sis ID.

Accelerate your compliance with the Instant Payment Regulation

European legislation on Instant Payment requires payment providers to offer instant, secure transfers accessible 24/7/365 throughout the European Union. Simplify your compliance with Sis ID technology:

- Meet your deadlines and reduce your integration costs by relying on a solution that is interoperable with all available Verification of Payee (VoP) schemes.

- Benefit from an ultra-secure, scalable technical infrastructure, designed to support your growth without compromising performance

- Reduce the number of problems your customers have when sending their payment files, thanks to the ongoing reliability of their payee repository